A1 certificates are essential documents that allow individuals to remain in their home country's national insurance scheme while working abroad. This is especially important for businesses with employees working in other EU countries.

However, when the Belgian social security inspectorate asked the institution which issued the A1 certificates to revoke them in criminal proceedings, it refused.

What is an A1 Certificate?

An A1 certificate is an official document that proves that an employee or self-employed worker is a part of to their home country's social security system. The A1 certificate permits the person to be exempt from contributing to social security in the host nation for a certain period of time. This is contingent on the country they are in and the duration of their business trip. It is crucial for those who is planning to work in an EU country or EEA/EFTA member state as well as self-employed professionals and civil servants.

If you're planning to travel to a country that requires an A1 certificate and you are required to bring it along. This can help to expedite their entry into the country and also shield them from a possible fine by the labor inspectorate. When applying for an A1 certificate It is recommended to use the correct form and to submit all relevant documents to get the proper approval. It is also an excellent idea to number your documents and declare the number of sheets in order that the labor inspectors can easily find them.

The process of obtaining an A1 certification differs from country to country, and can take anywhere between two weeks and several months. This is due to the fact that each country has its own A1 application process and procedures and the application must be submitted in the native language of the country.

For HR this process, it is usually accomplished by using an A1 certificate software application that takes care of the entire application and approval process on behalf of employees. This facilitates a quicker, more streamlined workflow and lessens the administrative burden for both employers and their employees.

If an employee is planning to travel to more than one country in which an A1 certification is required, the individual should contact their national social security agency to make the necessary arrangements. Health insurance coverage for those who are statutory should contact their insurance company. Privately insured or civil servants should contact the Pension House.

Many people travel to several European countries on business, but often travel without an A1 certificate. While this isn't likely to cause any issues with labor inspections, it can pose some risks in the event of a medical emergency or any other circumstance. In these situations, it is advisable for people to have an A1 certification so that they can provide proof of their home country's social security coverage to authorities in the case in the event of an emergency.

Why Do I Need an A1 Certificate?

The A1 certificate is an important document that allows individuals to keep their social security benefits and avoid double contributions while working in other countries. Without an A1 certification individuals may be required to pay into the social security systems of both their home and host country, which could be costly for employers and employees.

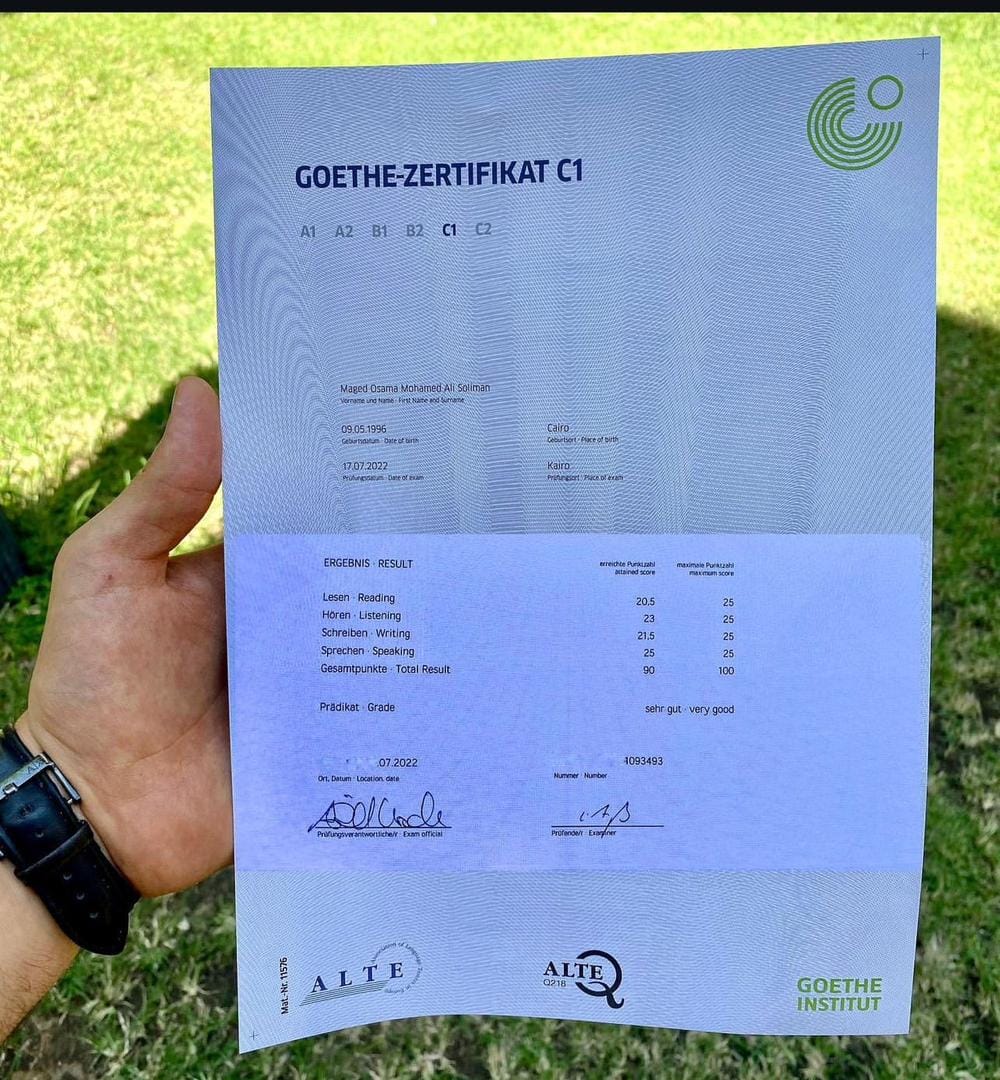

The A1 certificate proves that an employee or self-employed person has insurance coverage in their home country. It is required for all work trips or travel to other EU countries, as well as Iceland Liechtenstein Norway Switzerland and goethe institut zertifikat (check this link right here now) the United Kingdom. Although inspections on trains or on the freeway are not commonplace Social security authorities can inquire about individuals who are unable to provide an A1 certificate.

It is recommended that individuals apply for an A1 certificate when they realize that they are working in an EEA country. The application process is relatively simple, and the expense of getting an A1 certificate is far less than the possibility of being penalized by local social security authorities for non-compliance.

For UK-based businesses and individuals A1 certification is required to ensure compliance with post Brexit social security rules. These changes include adjustments made to the UK's bilateral agreement with EEA countries, as well as a renewed focus on avoiding fraud in cross-border employment.

No matter the nature, duration, or industry of the business A1 certificates are essential when working in another EEA country. This document helps prevent social and wage duplication where workers earn less in a host country than in their home country.

To help both employers and individuals make sense of these changes, WorkFlex offers a full suite of services to support the A1 certificate process. The WorkFlex A1 Cheat Sheet, for example, provides useful processing tips, common mistakes and solutions, as well as more. The cheat sheet also outlines significant changes to the rules regulations, procedures, and processes to obtain an A1 certificate following the Brexit. Click here to access the entire guide.

How do I get an A1 Certificate?

It is a lengthy and complex process to get an A1 Certificate. It is required to submit a comprehensive and complete application to the authorities in your country of residence. This could take a lot of time. The benefits of an A1 Certificate outweigh any inconvenience.

For instance for instance, the A1 Certificate allows individuals to avoid paying mandatory social contributions to multiple EU member states at the same time. This saves both employers as well as employees time and money by streamlining the administrative procedures involved. It also helps to preserve the rights and benefits that an individual's social insurance system gives while working in foreign countries. This is particularly important for companies that frequently send employees on business trips to various European countries.

In addition to that, the A1 Certificate also confirms which laws are applicable to an employee if they are in a different EEA or treaty country for a limited period of time. This is a vital aspect in avoiding double payments and other penalties.

To get an A1 certificate, the applicant must submit a form to the social security institution in their country of residence. The form typically includes details like the individual's name the nationality, address, employer and dates of employment. The application is sent to the appropriate authority for review. Once approved, the individual will receive an A1 certification in either digital or paper form. They must provide this document to the social security authorities in their country of residence and also provide copies to any coworkers they work with.

The A1 certificate is valid in all EU and EEA member states as well as Switzerland. The A1 certificate is not an alternative to a valid visa or work permit. It is still a valuable tool that employees should have prior to starting work abroad.

Check out our blog to find out more about the A1 Certificate. Download our A1 Certificate Guide, or use a tool such as Localyze to simplify your process. You can manage all the applications for employees who travel to work abroad using an easy dashboard.

Where can I find an A1 Certificate?

In order to work legally in an EU country an employee must possess a valid A1 certificate. This document lists the country of residence of an individual (where they are temporarily working) and the country of residence (their home country). It determines the country where their social security and taxes premiums are paid. The A1 certificate stops double payments and makes sure that employees only pay into systems to which they are entitled. In order to obtain an A1 certificate, one must contact their home or host country's social insurance institution. The process is complicated and differs from country to country. It is best to make an application well in advance of the travel.

All European citizens working in other countries must possess A1 certificates. The certificate is also required for anyone who travels to an EU country or EEA for business purposes. Switzerland is a signatory of the EC Treaty, is also covered by this directive. The A1 is a crucial document for companies that employ international workers or travel frequently for business.

The A1 certification process is controlled by Regulation 883/2004, which defines the rules for determining which social security law is in force when workers move between countries within the EU. This is to prevent "wage-and-social dumping" which is when employers take advantage of the tax differentials between their home and host country of their posted workers.

Therefore, it is important for employees to be aware of their rights and obligations in relation to social security and how they can safeguard themselves. It is crucial to get in touch with an expert who will answer any questions and assist employees in the process.

CIBT Assure streamlines your entire A1 certificate process, thereby saving you time and money. We can assist your employees understand the complicated requirements of this document and comply with the requirements of compliance. Our vast experience and understanding of immigration and social security as well as posted worker regulations will be an asset to you. Our expertise ensures that the submissions are correct, compliant and uninterrupted.

CIBT Assure's proprietary process allows us to anticipate and swiftly address potential issues that may cause a submission to be rejected by the nation's social insurance authority. This will save your employees from expensive penalties and unnecessary delays.