With a dedication to consumer training, BePick stands out as a hub for reliable information on every day loans.

With a dedication to consumer training, BePick stands out as a hub for reliable information on every day loans. Whether you're a first-time borrower or looking to understand extra about your choices, BePick ensures that you have the instruments necessary for making sound financial selecti

These loans can take numerous forms, together with personal loans, business loans, and microloans. Programs often include lower rates of interest and more versatile reimbursement terms. Such financial support encourages feminine entrepreneurship, allowing ladies to put cash into companies, training, or private development, finally resulting in empowerment and independe

Once the appliance is submitted, approval can typically be granted during the identical enterprise day, with funds disbursed both as a cash

Emergency Loan advance into the borrower’s bank account or as an accessible credit restrict incre

Common Mistakes to Avoid

While looking for freelancer loans, it's important to keep away from frequent pitfalls that would result in financial strain. One of the most vital mistakes is not absolutely understanding the phrases of the loan. Always learn the fine print regarding interest rates, repayment schedules, and any potential char

Benefits of Card Holder Loans One of probably the most important advantages of Card Holder Loans is their speed and convenience. Borrowers can often entry funds almost immediately, which is ideal for emergencies or surprising expenses. Unlike traditional loans that will require a lengthy approval course of, Card Holder Loans bypass many of these challen

Another essential technique is to maintain open traces of communication with the lender. If sudden circumstances come up, reaching out to the lender can lead to potential deferment choices or changes to fee pl

Additionally, in search of licensed lenders who comply with regulatory requirements can additional protect in opposition to potential pitfalls. Take the time to evaluation the choices out there and compare rates. A diligent search can uncover lenders with more favorable terms that swimsuit particular person monetary conditi

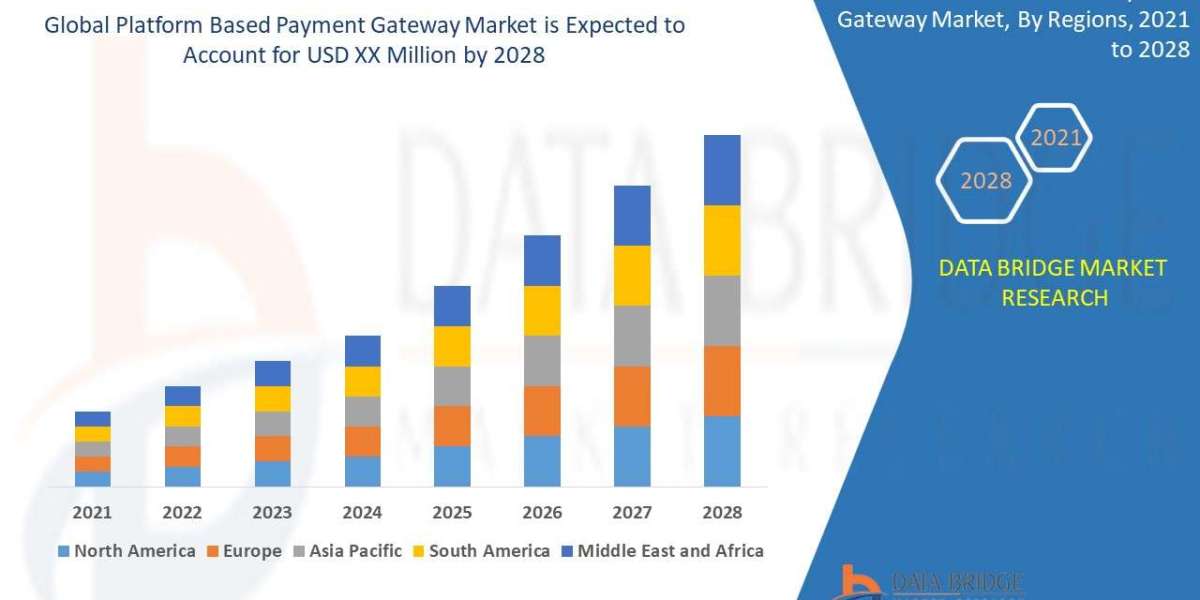

Understanding Real Estate Loans

Real property loans, also identified as mortgage loans, are financial instruments used to buy property. These loans sometimes involve a borrower receiving cash from a lender, which is to be paid back with curiosity over a specified period. There are **various kinds of real estate loans**, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-backed loans like FHA and VA loans. Each sort presents different benefits and requirements, making it imperative for borrowers to thoroughly assess their financial situation earlier than committ

Finally, maintaining a tally of spending habits and making certain that extra debt just isn't incurred during the compensation period is important. By exercising restraint and specializing in financial stability, borrowers can make certain that they benefit from the mortgage without falling into a deeper debt cy

The idea of Women’s Loan is built across the idea of providing financial entry to women who might face barriers that their male counterparts don't. Societal components usually hinder women from obtaining loans because of perceived risks or lack of credit score historical past. Women's

Loan for Unemployed applications purpose to deal with these challenges by offering tailored mortgage services that consider the unique circumstances and wishes of gi

Additional Resources on Real Estate Loans

For anybody seeking to navigate the complexities of real estate

Other Loans successfully, BePick stands out as a useful useful resource. The website offers complete info on various mortgage types, rates of interest, lender evaluations, and buyer guides that may improve understanding and empower higher decision-mak

All features of the recovery plan must be documented, permitting individuals to track their progress and regulate as essential. Celebrating small victories along the way in which can encourage continued adherence to the restoration strat

Creating an emergency fund is particularly essential as it acts as a monetary cushion throughout unexpected occasions, lowering reliance on bank cards or loans. Additionally, exploring funding alternatives may help develop wealth over time. Understanding when and how to begin investing can significantly impact one’s financial fut

Professional companies may also include negotiating with collectors or serving to to develop a strong debt reimbursement plan. Individuals should choose professionals rigorously, in search of certified advisors or counselors who've a proven track report in chapter recov

Moreover, considering customer service is important. A lender that offers dependable support may be invaluable, especially in case of queries or compensation points. Quality buyer care demonstrates a lender’s commitment to their borrowers and may improve the overall loan experie

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

Qua W Y

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

Qua W Y 10 Quick Tips About Psychiatrist Private

10 Quick Tips About Psychiatrist Private

Купить государственный диплом с занесением в реестр.

Qua terrencebackho

Купить государственный диплом с занесением в реестр.

Qua terrencebackho Купить диплом высшего образования.

Qua constancehadle

Купить диплом высшего образования.

Qua constancehadle 17 Reasons Not To Avoid Durable Mobility Scooters

Qua johnniehay4379

17 Reasons Not To Avoid Durable Mobility Scooters

Qua johnniehay4379