Strategies for Successful Loan Applications

Applying for small business loans on-line may be aggressive, and entrepreneurs have to adopt efficient methods to increase their possibilities of.

Strategies for Successful Loan Applications

Applying for small business loans on-line may be aggressive, and entrepreneurs have to adopt efficient methods to increase their possibilities of approval. Preparing a well-organized marketing strategy that clearly outlines financial projections and the way the funds shall be utilized can significantly affect lender percept

Online enterprise loans present numerous advantages, together with a streamlined utility process, quick approval times, and flexibility in funding quantities. Many on-line lenders are also keen to work with companies that will have difficulty securing conventional loans because of strict criteria, thus increasing entry to financial resour

Whether you are a seasoned entrepreneur or a newcomer to the

Business Loan world, BePick can help you in understanding the professionals and cons of fast business loans and to find an appropriate lender that meets your specific needs. This structured strategy to enterprise funding can lead to extra successful outcomes and improved monetary well being for your organizat

Additionally, many on-line lenders provide aggressive interest rates in comparability with traditional monetary establishments. Thanks to decreased overhead costs, these firms can typically present higher phrases, which can result in vital savings over the life of the mortg

Documentation is another critical side of the applying process. Required paperwork may include tax returns, business plans, and financial statements, aimed toward evaluating the enterprise's overall financial health. Being ready can streamline the application process and probably enhance approval chan

Checking the lender’s credentials is important. Ensure they are licensed and regulated by the relevant authorities. This offers debtors peace of thoughts, figuring out they are working with a reputable supplier. Additionally, review the precise terms of loans offered, including rates of interest, compensation periods, and any hidden f

Types of Online Loans Available

Online lenders offer a various array of mortgage products suited for varied business wants. Term loans are one of the most common options, providing a lump sum that is paid back over a onerous and fast period with curiosity. Such loans are ideal for vital investments or one-time bi

In today’s fast-paced business setting, securing financial help could be a defining factor for small businesses aiming to develop and thrive. Small business loans online offer a practical resolution, providing entrepreneurs with fast entry to funds for various purposes. Whether it's expanding operations, investing in new technology, or managing money circulate, understanding the nuances of on-line financing choices becomes crucial. This article focuses on the dynamics of obtaining small enterprise loans online whereas highlighting the invaluable assets obtainable at 베픽, a premier web site providing comprehensive information and critiques on this important subj

Lastly, protected online loan companies often cater to various credit profiles. Some lenders concentrate on loans for individuals with less-than-perfect credit, providing options that traditional banks could deny. This inclusivity allows extra debtors to secure the funds they n

If debtors aren't careful, the value of borrowing can escalate, leading to cycles of debt. This is particularly precarious for those already experiencing financial strain, where taking out one other mortgage could look

like this the one option to cover present money o

By leveraging the assets available on Be픽, debtors can guarantee they are making clever choices tailored to their particular financial conditions, finally leading to raised loan outcomes and extra manageable monetary hea

Additionally, sustaining a powerful credit rating by managing money owed responsibly performs a critical role in enhancing an utility's attractiveness. Entrepreneurs must also guarantee transparency by offering comprehensive financial documentation, which reinforces credibil

Once you receive the funds, it’s important to plan your repayment technique. Make positive to understand your reimbursement schedule and keep away from lacking funds, as this will lead to additional fees and impression your credit score rating negativ

Understanding Small Business Loans Online

Small business loans on-line are financial merchandise designed specifically for entrepreneurs and small business homeowners. These loans can be accessed through varied online lenders, providing a handy various to traditional banks. Entrepreneurs often turn to these loans for swift funding options that may gasoline growth and stabil

In today's financial landscape, acquiring a mortgage on-line has turn out to be a typical solution for so much of individuals and companies. However, with a plethora of options out there, it is essential to discern which online

24-Hour Loan companies present secure and dependable companies. This article delves into the features that characterize safe online loan corporations, provides guidance on tips on how to consider them, and introduces 베픽 as a valuable useful resource for detailed information and evaluations on this topic. Understanding these aspects will empower debtors to make knowledgeable selections, guaranteeing their monetary well-be

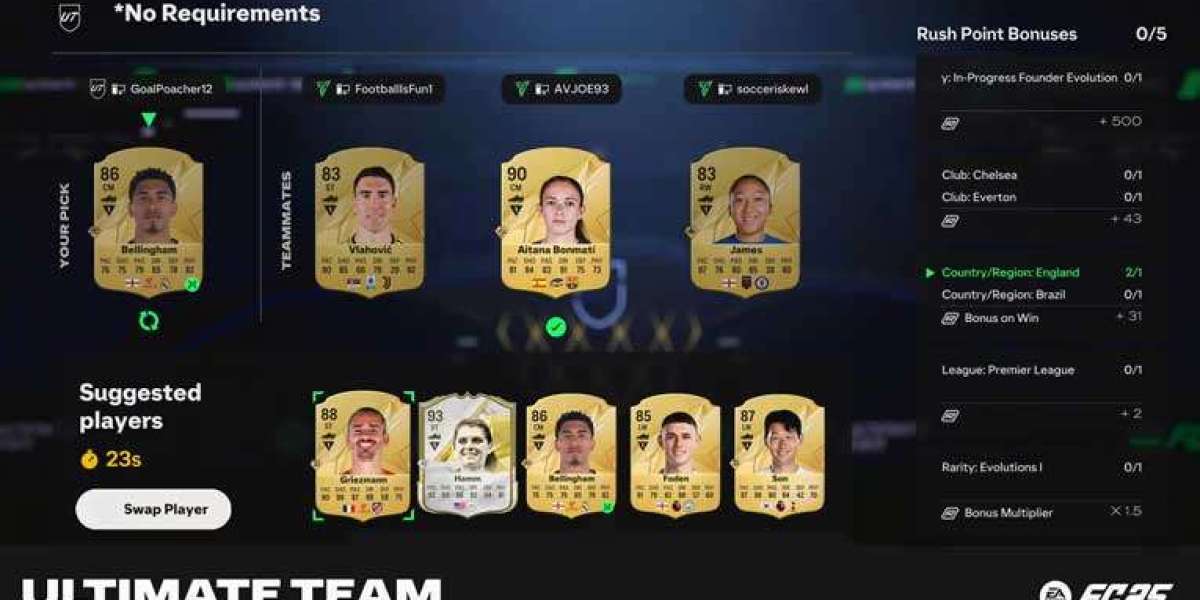

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

Sa pamamagitan ng W Y

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

Sa pamamagitan ng W Y 10 Quick Tips About Psychiatrist Private

Sa pamamagitan ng iampsychiatry2628

10 Quick Tips About Psychiatrist Private

Sa pamamagitan ng iampsychiatry2628 Купить государственный диплом с занесением в реестр.

Sa pamamagitan ng terrencebackho

Купить государственный диплом с занесением в реестр.

Sa pamamagitan ng terrencebackho Купить диплом высшего образования.

Sa pamamagitan ng constancehadle

Купить диплом высшего образования.

Sa pamamagitan ng constancehadle 17 Reasons Not To Avoid Durable Mobility Scooters

Sa pamamagitan ng johnniehay4379

17 Reasons Not To Avoid Durable Mobility Scooters

Sa pamamagitan ng johnniehay4379