Next, compare numerous sites to weigh interest rates and associated fees.

Next, compare numerous sites to weigh interest rates and associated fees. This side-by-side evaluation permits you to identify the most cost-effective solutions out there and avoid any surprising costs down the r

Potential Drawbacks to Consider

Despite the benefits of on-line cash circulate loans, it is important to consider potential drawbacks. One of the primary considerations is rates of interest, which may be greater than traditional financial institution loans. While online lenders typically provide fast entry to funds, this comfort could come at a premium, particularly for businesses with less-than-ideal credit histor

Microloans, on the opposite hand, are a fantastic choice for gig workers trying to fund small initiatives or enterprise endeavors. These loans present lower quantities of capital and are often simpler to qualify for, making them appropriate Emergency Fund Loan for people who need fast funding without a long-term commitm

By offering a platform for comparing

Emergency Fund Loan loans, sharing consumer experiences, and understanding borrowing higher, Bekp helps people navigate the usually complicated landscape of low-income online loans. Accessible information is significant to making sure debtors can select ethically responsible lenders and favorable

Mobile Loan phra

Advantages of Using Quick Loan Approval Sites

Quick mortgage approval sites offer several advantages over traditional lending methods. The most significant profit is undoubtedly the pace at which loans could be secured. Many borrowers recognize the power to entry funds within a day, avoiding extended financial str

Many gig staff juggle multiple jobs, which can affect their creditworthiness from a lender's perspective. Freelancers, rideshare drivers, and delivery personnel often have fluctuating incomes that complicate their ability to safe loans. This variability can lead to missed alternatives not only for private financial administration, but in addition for professional developm

Unlike traditional loans from banks or credit unions, which often require in-person visits and lengthy evaluations, quick approval loan apps cater to a dynamic and tech-savvy inhabitants. They function on ideas of accessibility, efficiency, and convenience. This signifies that even those with less-than-perfect credit data can generally find appropriate choi

Understanding the Gig Economy

The gig economic system is a flexible labor market characterised by short-term contracts and freelance work, quite than everlasting jobs. As more folks have interaction on this various work structure, they often discover conventional financing choices inadequate. The variable and infrequently unpredictable revenue typical of gig work makes lenders cautious, resulting in challenges in accessing fu

Alternatives to Online Cash Flow Loans

While on-line cash circulate loans current a viable resolution for businesses facing liquidity issues, they aren't the only possibility out there. Businesses may contemplate alternate options such as traces of credit, service provider cash advances, or bill financing. Each of those choices has its execs and cons, and deciding on the best one will depend upon the specific monetary scenario of the enterpr

Another important advantage is the assist and sources available. Platforms like Bekp provide comprehensive info and reviews concerning completely different lenders, lending practices, and client experiences. This wealth of data can help debtors in selecting the right choice tailored to their unique ne

The surge in demand for fast mortgage approval options could be attributed to various components, such as sudden medical bills, residence repairs, or different unexpected financial burdens. Traditional strategies often contain lengthy credit checks and intensive paperwork, which might delay the process and delay essential funds.Quick mortgage approval sites address these points by providing a streamlined application process, where customers can fill out types online with primary i

Another noteworthy feature is the user-friendly interfaces that simplify the applying process. Most apps are designed to be intuitive, permitting customers to navigate seamlessly via steps. Moreover, many loan apps supply versatile repayment plans, enabling debtors to pick options that align with their monetary capabilities. This flexibility can reduce the stress typically related to debt reimbursem

Furthermore, the aggressive nature of on-line lending has led to a range of options for borrowers. Many web sites serve as aggregators, allowing potential borrowers to compare a number of lenders and their terms in a single place. With entry to numerous rates of interest and reimbursement plans, individuals can make choices that align carefully with their monetary capabilit

Managing money flow is an important aspect of any business’s financial well being, and online cash circulate loans can present the mandatory support when unexpected expenses come up. This article will delve into the intricacies of online money circulate loans, together with how they work, their advantages, and key concerns for companies. Additionally, we are going to explore how the 베픽 website serves as a complete resource for those looking for information and evaluations concerning on-line cash flow lo

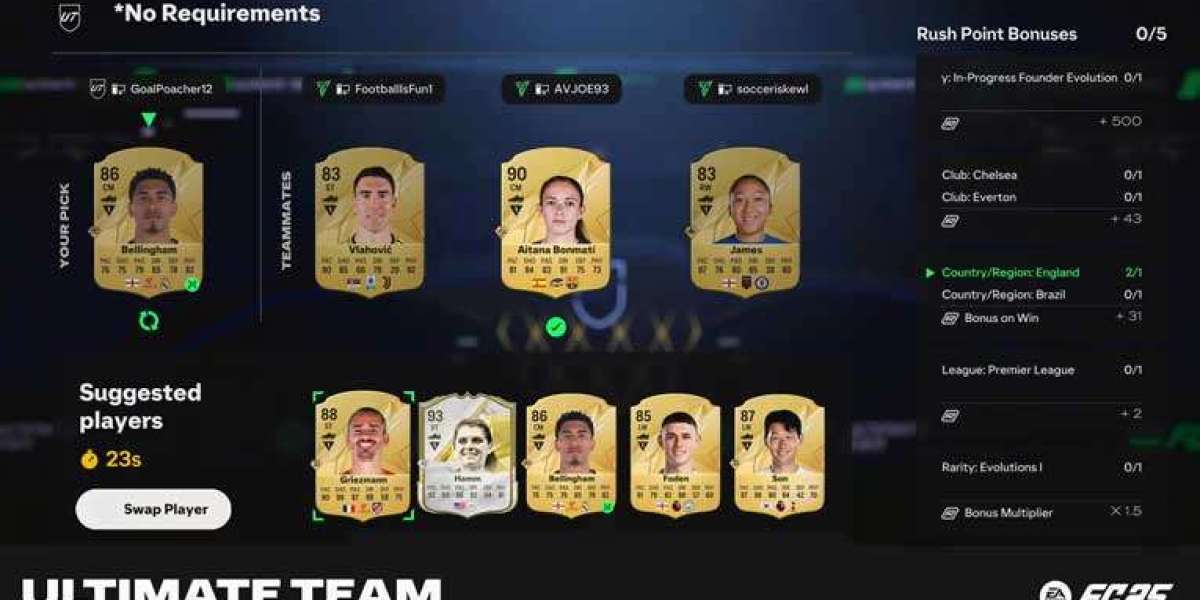

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

توسط W Y

Antwerpens unge Ileni Keina gör historiska Barcelona-mål i "fel" tröja - här är anledningen

توسط W Y Купить диплом высшего образования.

توسط constancehadle

Купить диплом высшего образования.

توسط constancehadle Купить государственный диплом с занесением в реестр.

توسط terrencebackho

Купить государственный диплом с занесением в реестр.

توسط terrencebackho Купить диплом зарегистрированный в реестре.

توسط susanoreily126

Купить диплом зарегистрированный в реестре.

توسط susanoreily126 10 Quick Tips About Psychiatrist Private

توسط iampsychiatry2628

10 Quick Tips About Psychiatrist Private

توسط iampsychiatry2628